What are Accelerators?

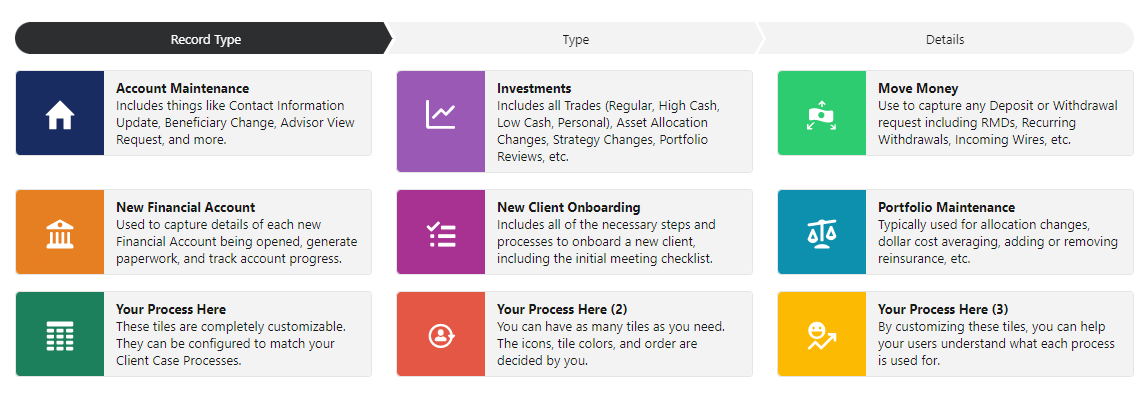

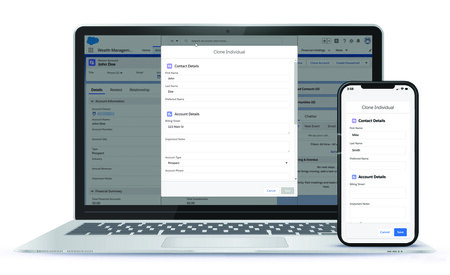

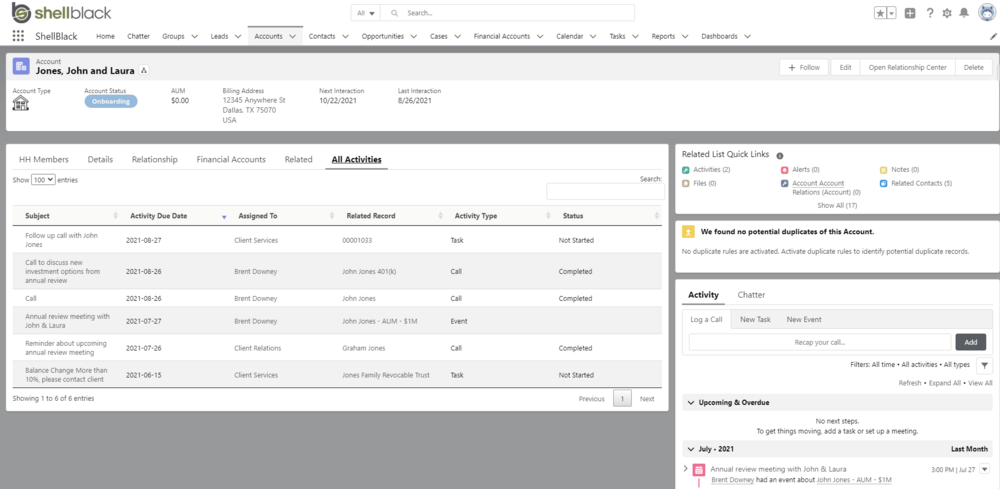

The best Salesforce partners use their vast experience in wealth management tech to support firms of all sizes and maturity levels. That’s why we’ve created ShellBlack’s Accelerators for Salesforce Financial Services Cloud (FSC) — CRM software for financial advisors that’s easy to deploy and configure. These cost-effective solutions draw upon the knowledge and skills gained during our many implementations to help clients address common use cases. By leveraging ShellBlack Accelerators, Salesforce users not only realize more business value and utility from their wealth management CRM solution — they also benefit from reduced development costs and time.

These road-tested solutions are designed to enhance the end-user experience — whether by reducing clicks to increase efficiency, providing custom visualizations that highlight exceptions and make information actionable, or facilitating data integrations that provide users a single pane of glass to understand and manage their customer relationships.