Unlocking the Power of Multi-Custodial Data Aggregation for RIAs

In today’s digital-first wealth management landscape, client expectations are evolving as rapidly as technology. Real-time insights, personalized service, and seamless access to comprehensive financial data are no longer just nice to have — they’re essential.

In a recent joint webinar, industry leaders came together to address dynamic ways to keep up with these rising expectations. The expert panel featured Shell Black, president and founder of ShellBlack; Greg Glaser, solution engineer at ShellBlack; and Dave Hagen, chief commercial officer at BridgeFT.

The Multi-Custodial Data Aggregator: Access 900+ Feeds Within Salesforce

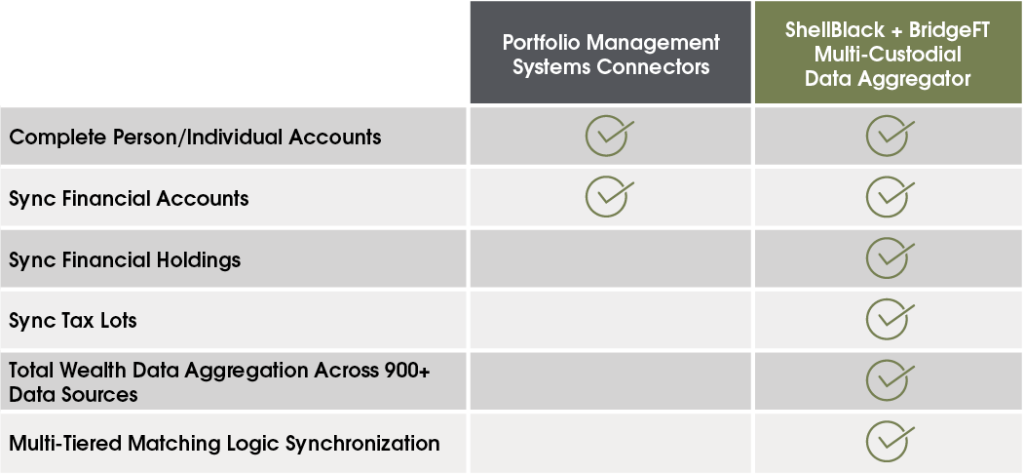

The Multi-Custodial Data Aggregator represents a significant advancement in wealth management technology, offering seamless integration with more than 900 direct feeds from major financial institutions, including Charles Schwab, Fidelity Institutional, Pershing Advisor Solutions, and Interactive Brokers. This platform-agnostic solution feeds clean, normalized, multi-custodial data directly into Salesforce, unlocking numerous downstream benefits, such as:

- Real-time access to account data

- Complete visibility across households, accounts, and holdings

- Data-driven workflows and automation

- Native Salesforce dashboards and reporting

The key differentiator? The data truly resides in Salesforce — not just displayed but living within the platform to power automation and personalized service delivery.

About the Innovators: Salesforce and WealthTech Experts

ShellBlack and BridgeFT have formed a powerful partnership in wealth management technology, combining ShellBlack’s 100,000+ project hours in wealth-focused Salesforce consulting with BridgeFT’s innovative cloud-native WealthTech-as-a-Service platform. Together, they created a solution that helps financial institutions and advisors streamline data management, automate back-office operations, and create personalized client experiences through advanced technological infrastructure.

Inside the Advisor Experience: A Live Walkthrough

Greg Glaser from ShellBlack conducted a comprehensive demo of Financial Services Cloud (FSC) enhanced with the BridgeFT integration, highlighting the practical capabilities for advisors.

Household-Level Visibility

Advisors gain a complete picture of client relationships, including:

- Family structure and relationship mapping

- Demographics and profile details

- Linked financial accounts and entities

Detailed Account and Holdings Insights

The demo showcased deep-dive capabilities, including:

- Account-level details for various account types (IRAs, Roths, 529s)

- Full holdings breakdown with performance data

- Multiple view options (tabular and visual)

Particularly impressive was the lot-level detail, allowing advisors to view individual tax lots and transaction histories; access CUSIP identifiers, custodians, and account numbers; and track reported values, gain/loss, and cost basis.

Powerful Dashboards and Oversight

With data fully embedded in FSC, firms can create rich advisor dashboards featuring:

- Total portfolio value

- Available cash

- Client-by-client breakdowns

- Real-time portfolio summaries

Key Takeaways

The webinar made one thing abundantly clear: The era of manually toggling between systems and working with stale data is ending. When multi-custodial data lives inside Salesforce, advisors gain a more client-centric, single source of truth with enhanced automation capabilities.

Want to Learn More?

Watch the webinar recording or contact us directly if you’re interested in bringing resident custodial data from more than 900 sources into your Salesforce environment.