Welcome to the Salesforce Agentic Enterprise

It was only two short years ago, at Dreamforce 2023, that Marc Benioff took a cautionary stance toward artificial intelligence (AI), using his keynote address to warn that AI could lead to a dystopian future. This year, the emphasis on hallucinations or the need for AI governance was completely absent. Instead, the focus amplified last year’s theme of humans and AI agents working together to accelerate growth. In his keynote address, Marc was upbeat, in his element, and back to his old ringmaster self. The message was clear — full speed ahead! Welcome to the Salesforce agentic enterprise!

Rebranding, Yet Again

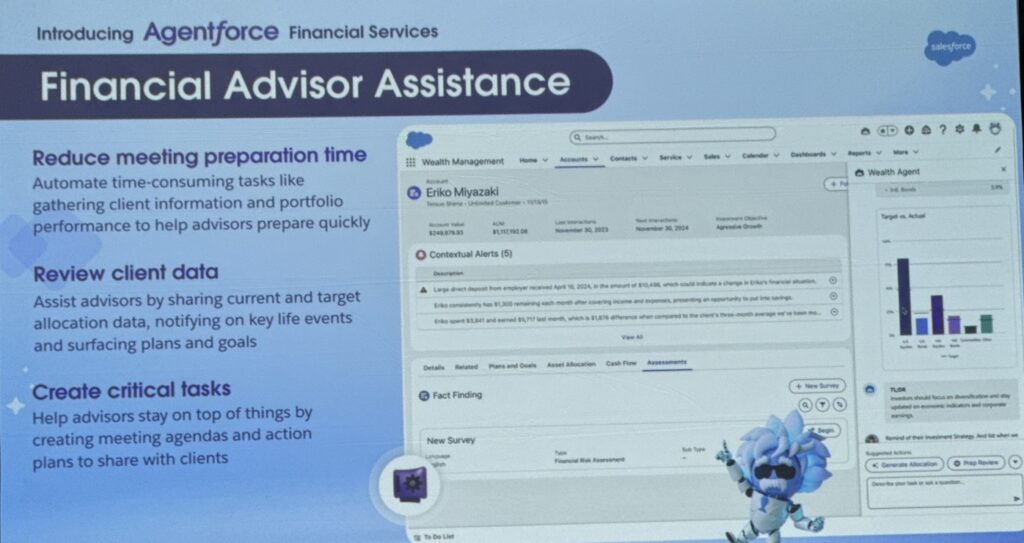

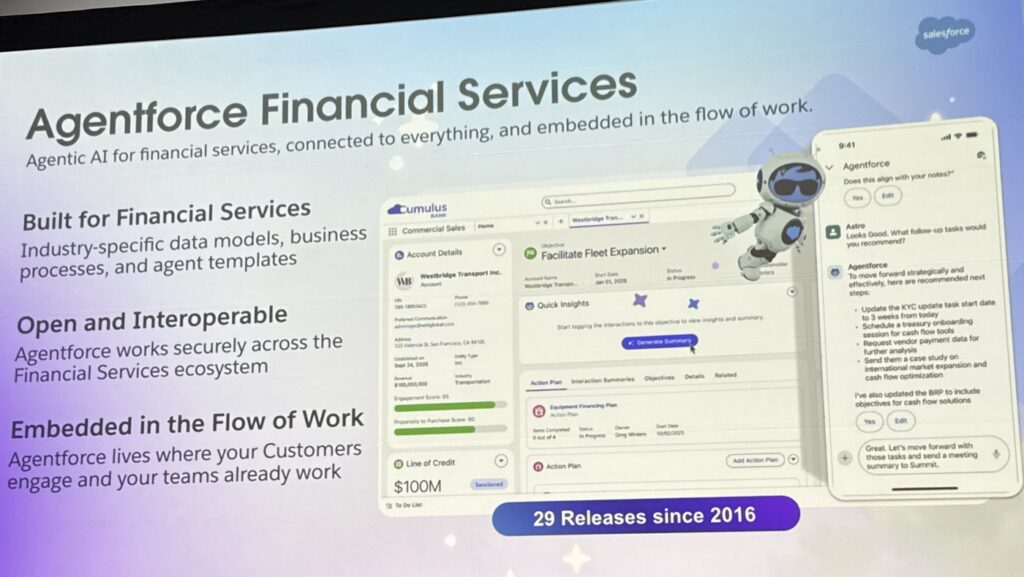

The last two years, we’ve seen the transition from Copilot, to Einstein, to Agentforce. This year, Salesforce announced that the core platform is now called Agentforce 360, and that AI agents will be embedded in all products. To that point, Financial Services Cloud (FSC) is now called Agentforce 360 for Financial Services. During Dreamforce sessions however, this was shortened to Agentforce Financial Services. This blog post references the product by both its old and new name(s) as needed for clarity.

Agentforce for Wealth Management

Emphasis on Core vs. Managed Package

Dreamforce attendees who visited the expo at the bottom of the Moscone Center this year may have noticed that FSC was conspicuously absent. Data Cloud, yes. Slack, yes. Tableau, yes. MuleSoft, yes. FSC, no. We suspect that FSC is now considered part of the Core Salesforce Agentforce 360 platform rather than a separate product.

To further that point, the session titled Empower Wealth Advisors with Industry-Specific AI (see below) mentioned that the “out-of-the-box” preconfigured agents only work with “standard objects.” Translation — the Core version of FSC comes with preconfigured agents; the Managed Package version of FSC does not. To learn more about the differences between the FSC Core and the Managed Package, this blog post has an excellent breakdown. The session speaker, Jeremy Schowalter, did say that at some point, preconfigured agents should be available in the FSC Managed Package.

Light on Wealth Content

Overall, I found the wealth management content at Dreamforce very light; I could only find three representative sessions in the Dreamforce Agenda Builder app. In years past, Greg Beltzer was a strong advocate for client innovation in wealth management. However, after seven years with RBC, he left to join Salesforce as their new chief customer officer for AI, Agentforce. He took this position only two months ago, so it probably should not have been surprising that I could not find a session with Greg as a speaker. With Greg no longer on the customer side, I suspect Salesforce will be searching for new customer testimonials.

Session: Reimagine Wealth Management: Powering Next-Gen Growth

This session was a panel discussion with Mark Harris, SVP, Innovation Office at Mariner Wealth Advisors; and Inez Louzonis, managing director at Merrill Lynch.

Inez spoke about using AI to ask about internal policies stored in a large language model (LLM). Merrill Lynch’s emphasis has been on the meeting journey — meeting preparation (whether with an existing client or a prospect), and summarizing the meeting as notes along with follow-up tasks. She mentioned that they are doing a pilot with market data (e.g. how has Tesla performed this year?).

Mark talked about how AI will reduce administrative work and allow financial advisors to spend more time interacting with clients. He saw digital appointments as a huge time-saver.

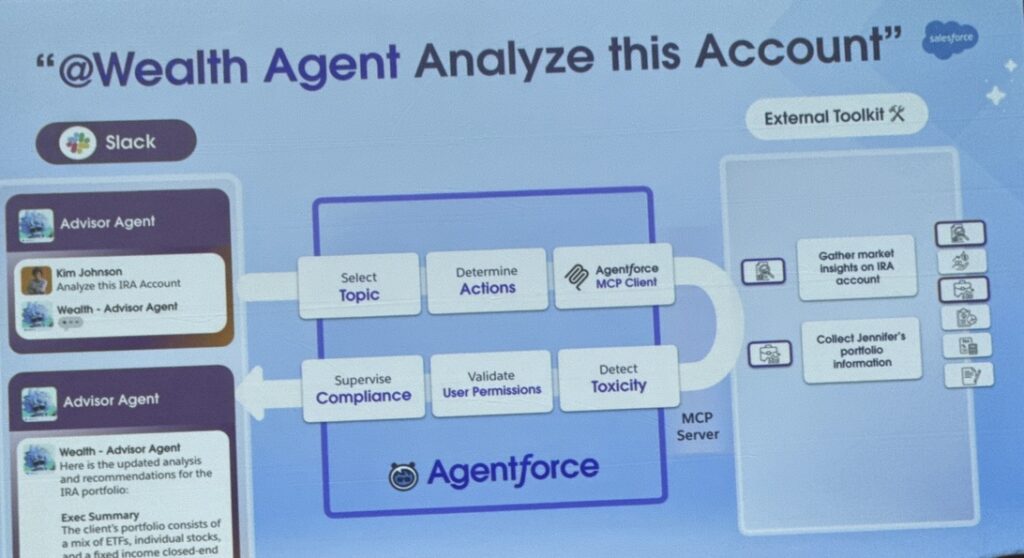

Slack as a Conversational Interface for Financial Advisors

The session ended with a demo that positioned Slack as the advisor’s desktop. Within Slack, a financial advisor could ask their Advisor Assistant, “What should I be focused on today?”

Slack Advisor Desktop

Agent’s Suggestions for an Advisor

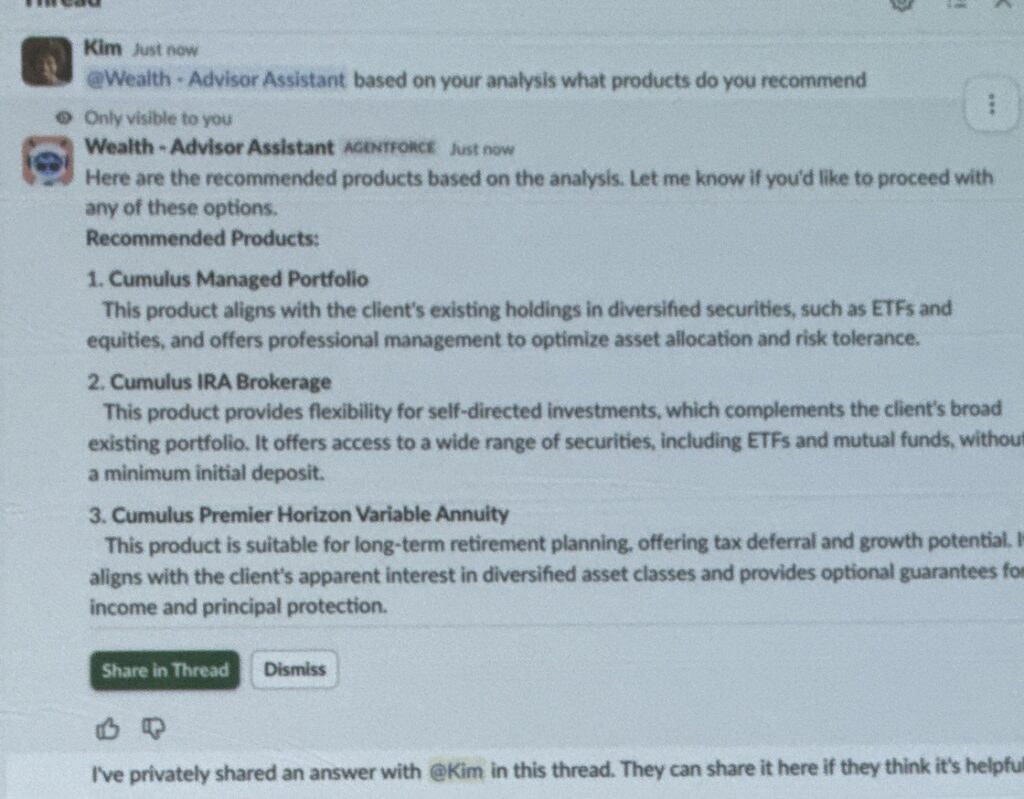

In the demo, the advisor asked the agent to analyze an IRA portfolio …

and make recommendations on what products to consider.

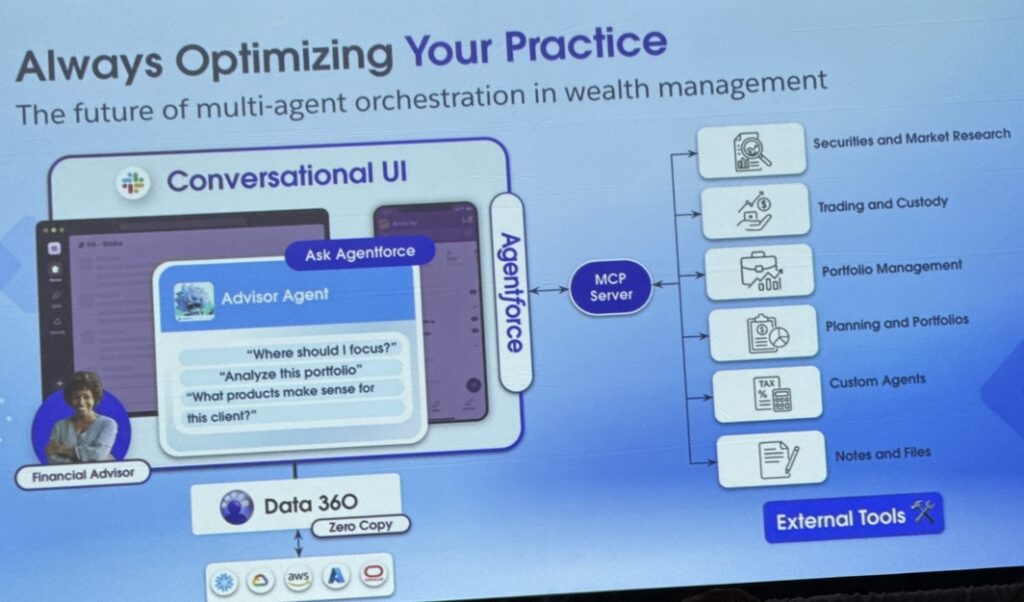

The demo closed with a slide highlighting the architecture needed to support these types of AI prompts.

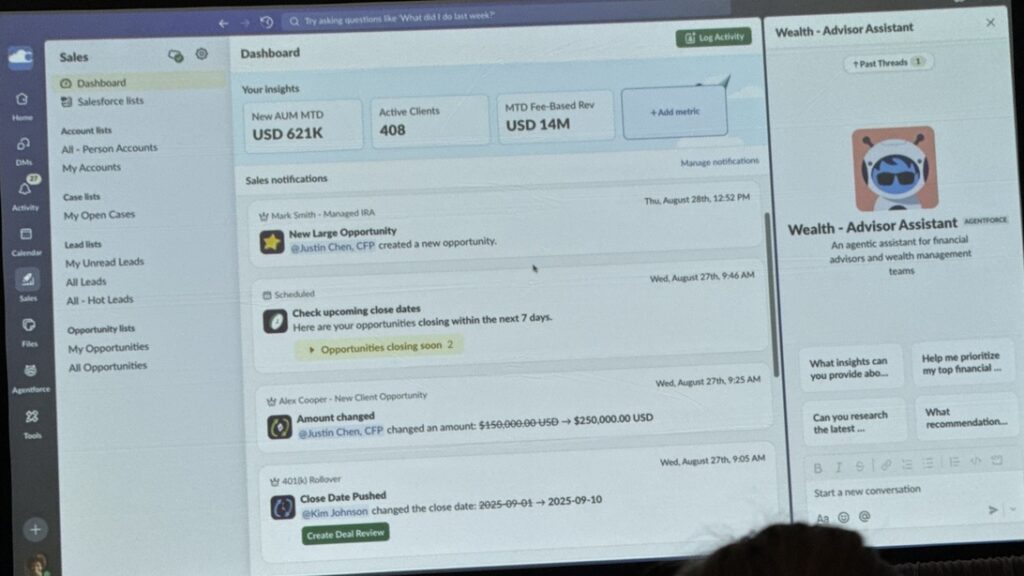

I struggled with this “Slack first” vision, as most wealth firms use Microsoft Teams rather than Slack. Positioning Slack as the advisor user experience (AUX) could be self-serving for Salesforce. Once a wealth management firm purchases FSC and perhaps Shield, there is not much else Salesforce can sell them in the product suite. Back at Dreamforce 2023, Salesforce hinted that Slack could be the user interface (UI) for Salesforce. In a later session, Salesforce showed the Advisor Agent, as a component resident inside Salesforce, as an alternative interface, but both are setting the vision of an omnipresent agent in the wings waiting to have a conversation with a financial advisor.

Salesforce Advisor Desktop

Session: The Agentic Enterprise for Financial Services

This session was led by Kelly Utley, senior director, Product Marketing; Chirag Mehta, senior director, Product Management; and Pavan Kumar Kota, senior director, Product Management. It was a floodgate of slides and demos. Kudos to the presenters for packing in a lot of well-orchestrated content in a very short period of time.

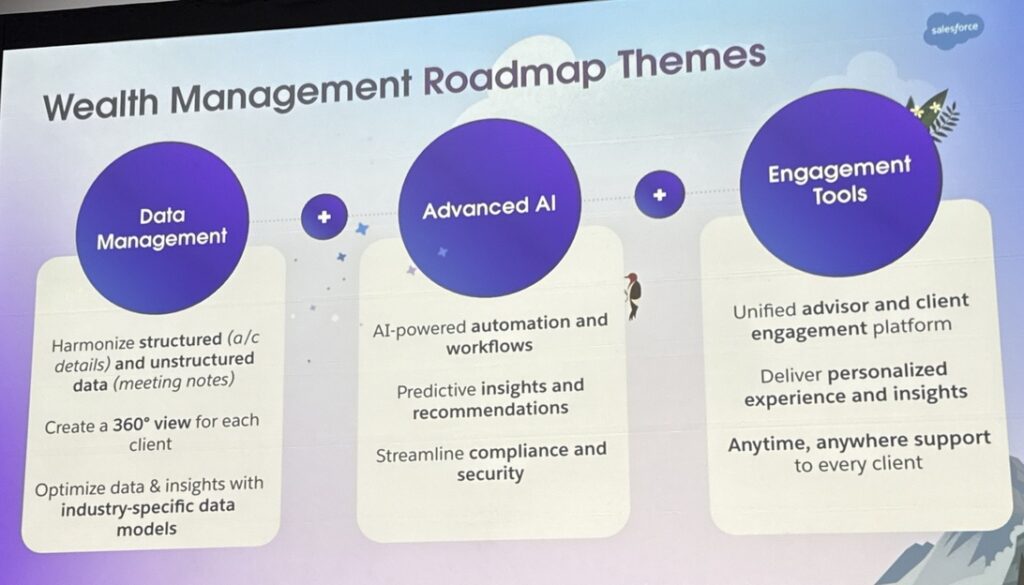

NOTE: This was a roadmap session — a lot of this content is visionary in nature and does not represent generally available functionality.

The first takeaway was that in the agentic enterprise, the user experience will be less about clicking and entering data and more about prompts and having a conversation.

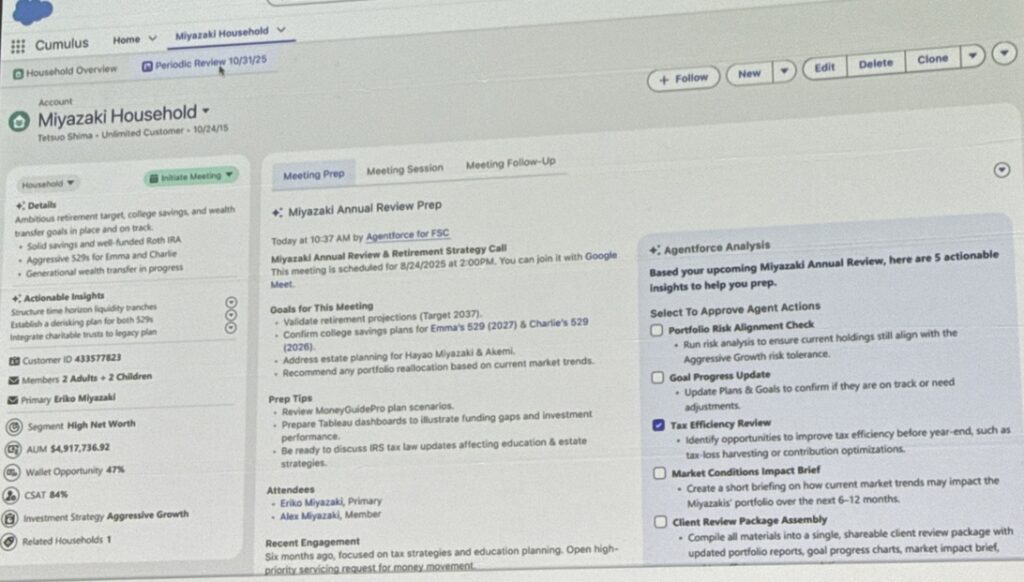

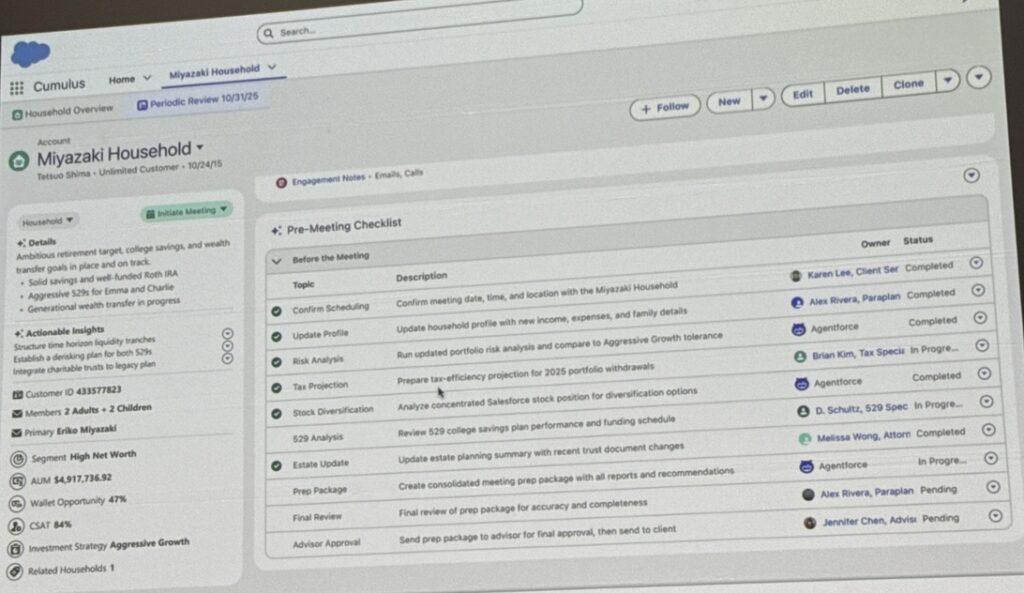

In their demo as a financial advisor, they showed a UI with an upcoming client review with a checklist that the advisor could use to select topics or agenda items. In the screenshot below, notice the three tabs: Meeting Prep, Meeting Session, Meeting Follow-Up. Here, Salesforce is laying out the three phases of a meeting life cycle.

Meeting Prep

Pre-Meeting Checklist

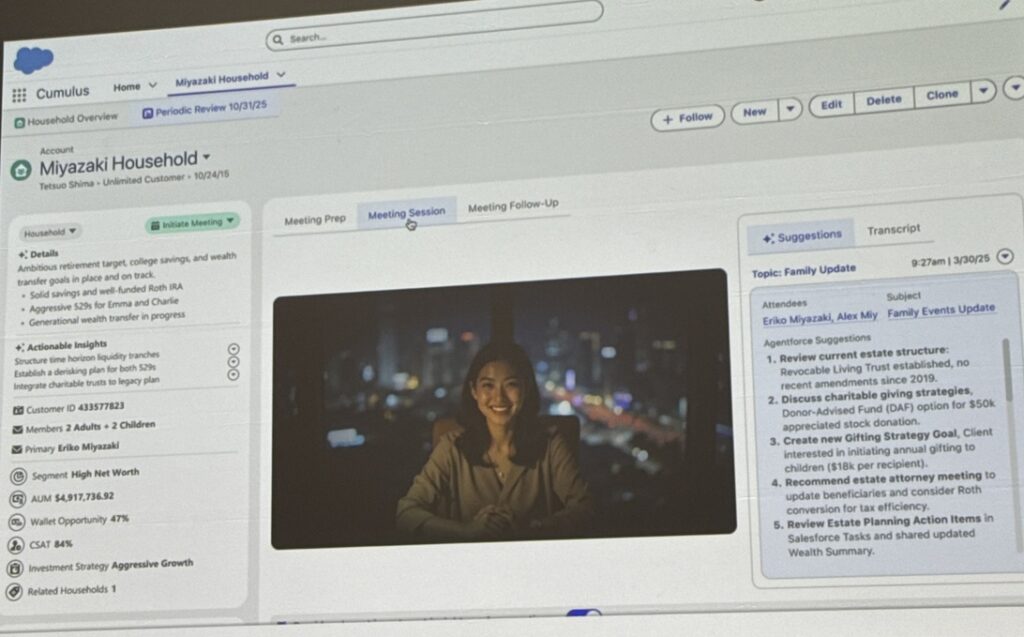

In the Meeting Session tab, they showed an interface where you might be able to embed the meeting video while Agentforce produced a transcript and suggested topics.

Embedded Video

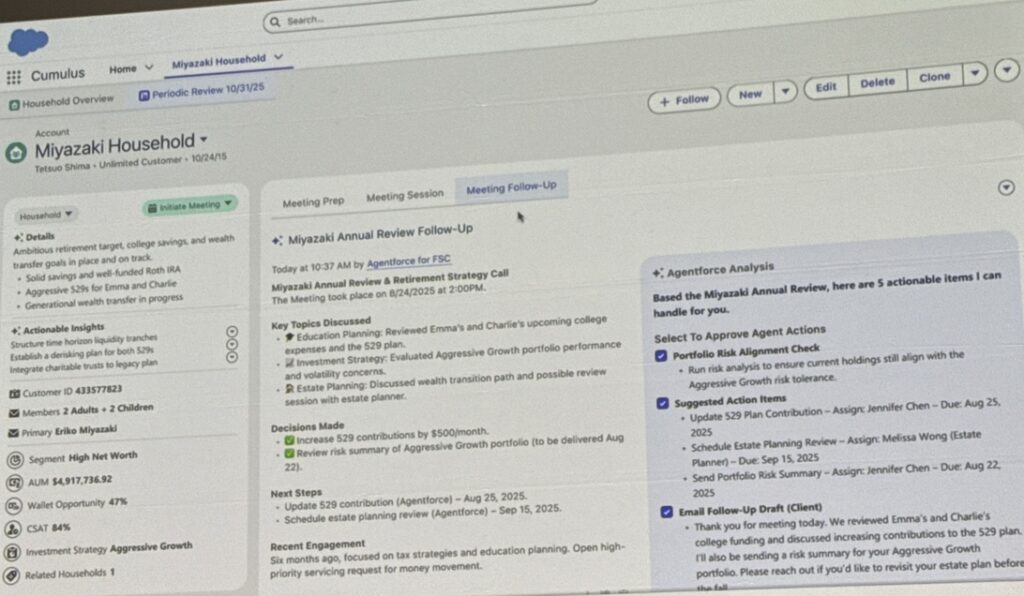

In the Meeting Follow-Up tab you could capture post-meeting action items and follow-up tasks suggested by your agent.

Meeting Follow-up

As they closed out the Agentforce highlights for wealth management, they mentioned that Salesforce was partnering with a data aggregator (safe harbor) so firms would not have to roll their own integrations. I believe this would be an AppExchange solution. Salesforce has traditionally avoided creating specific integrations as a product, as they do not want to support or maintain the solution. For example, it would be a nightmare for Salesforce to maintain all the financial products needed for a new account opening (NAO) with multiple custodians.

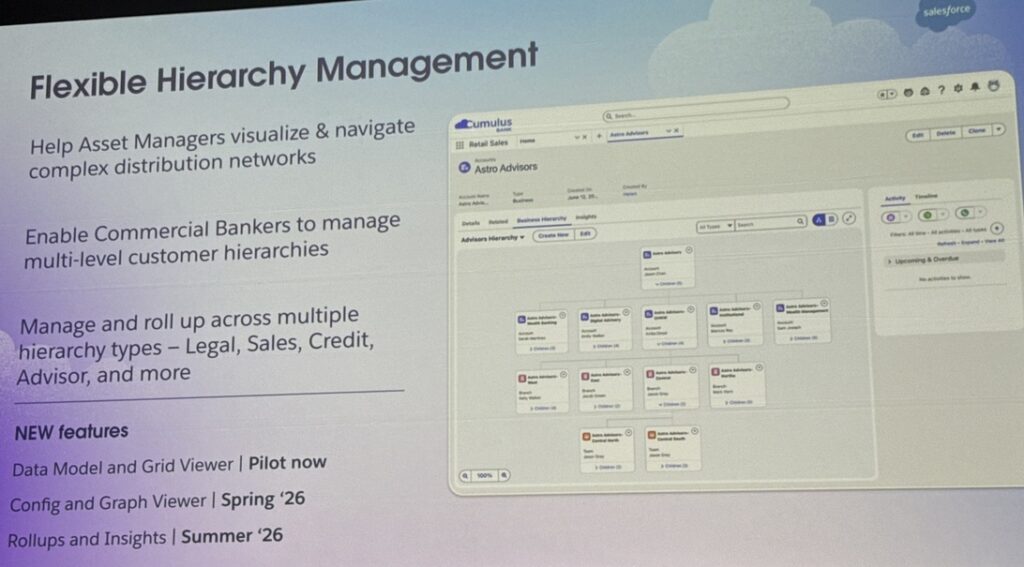

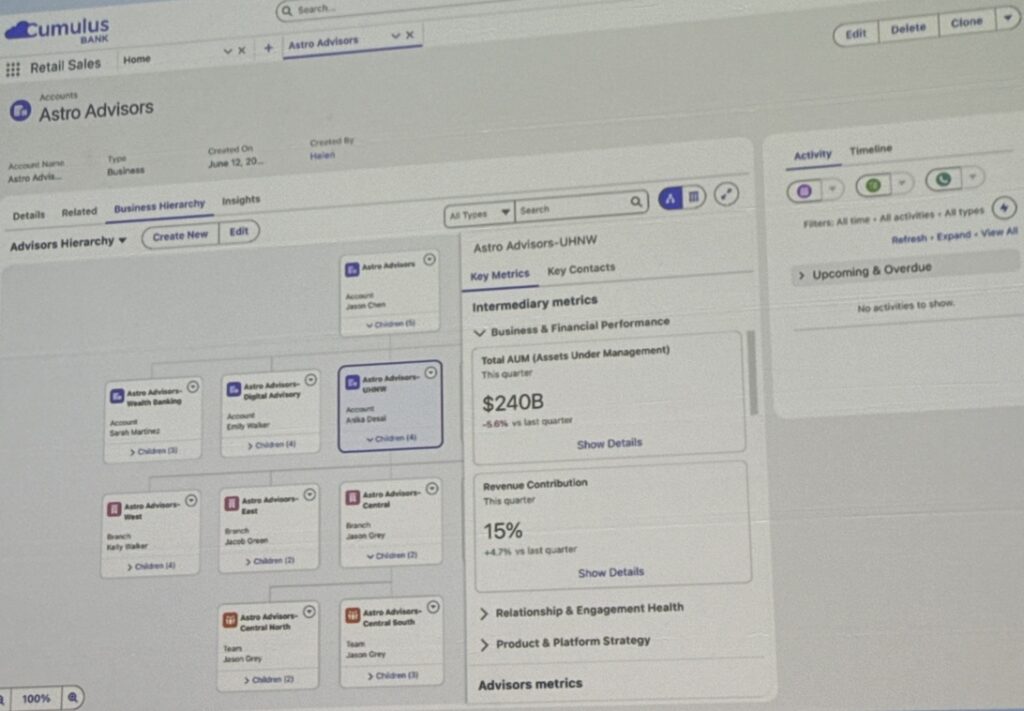

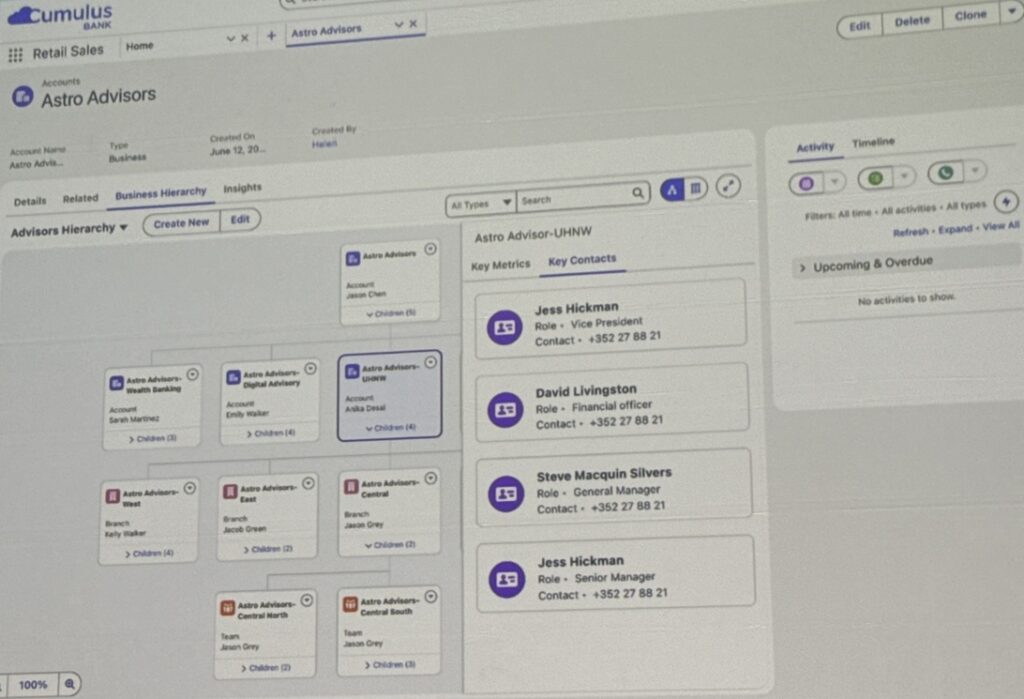

The middle part of the presentation was geared toward asset management. I found the Flexible Hierarchy Management feature intriguing. It would be helpful for visualizing acquisitions or multilayered business entities. Though the Flexible Hierarchy Management was presented in the context of asset management, I couldn’t help but think how it might be applied to wealth management. I really liked how you could click on a node in the hierarchy and toggle between key contacts or access a roll-up of key performance metrics. (Note the roadmap release dates in the bottom left corner of this slide).

Roll-Up Metrics

Roll-Up Contacts

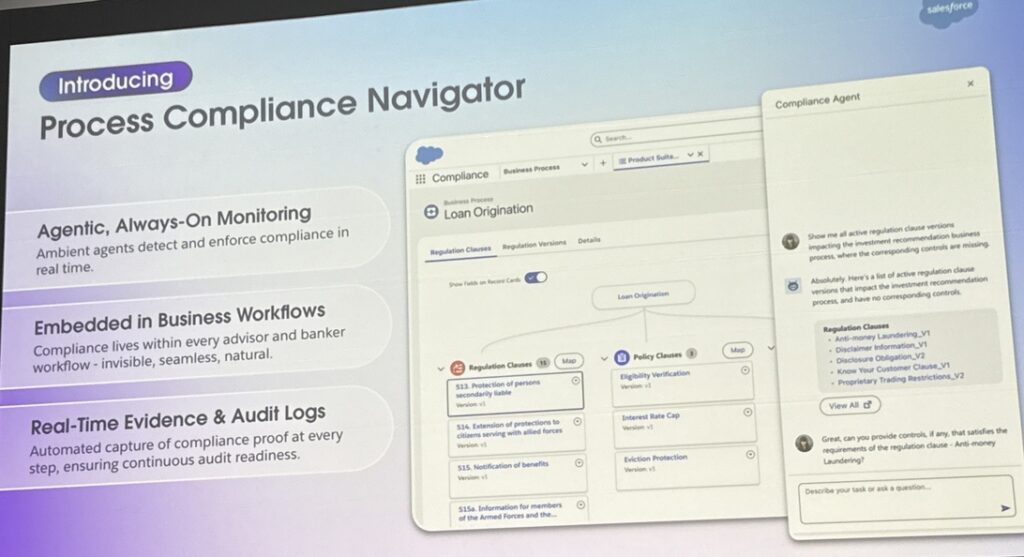

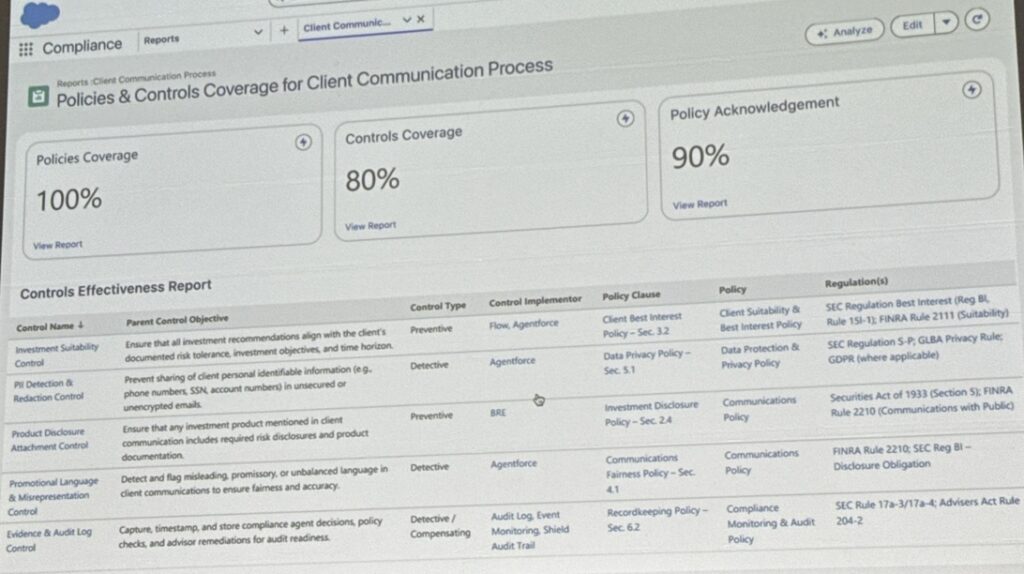

The final part of the presentation was on Compliance Navigator. The goal here is to deliver a unified solution to set up and proactively monitor compliance inside Salesforce using Agentforce.

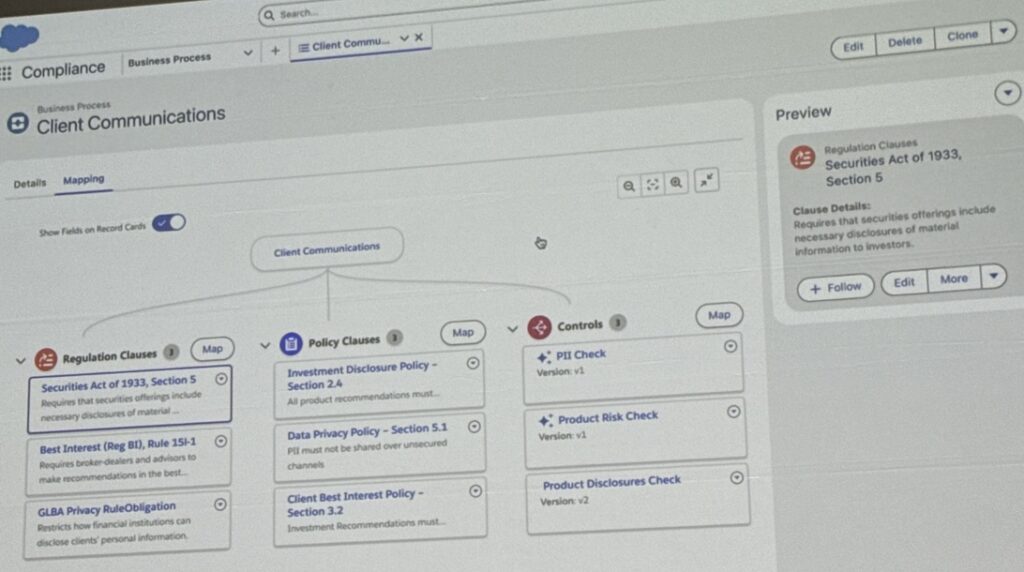

From what I could tell, you compile all your regulations into an LLM for your agent to summarize. That information becomes a “Business Process” with rules for your agents to monitor. Below is an example client communication Business Process.

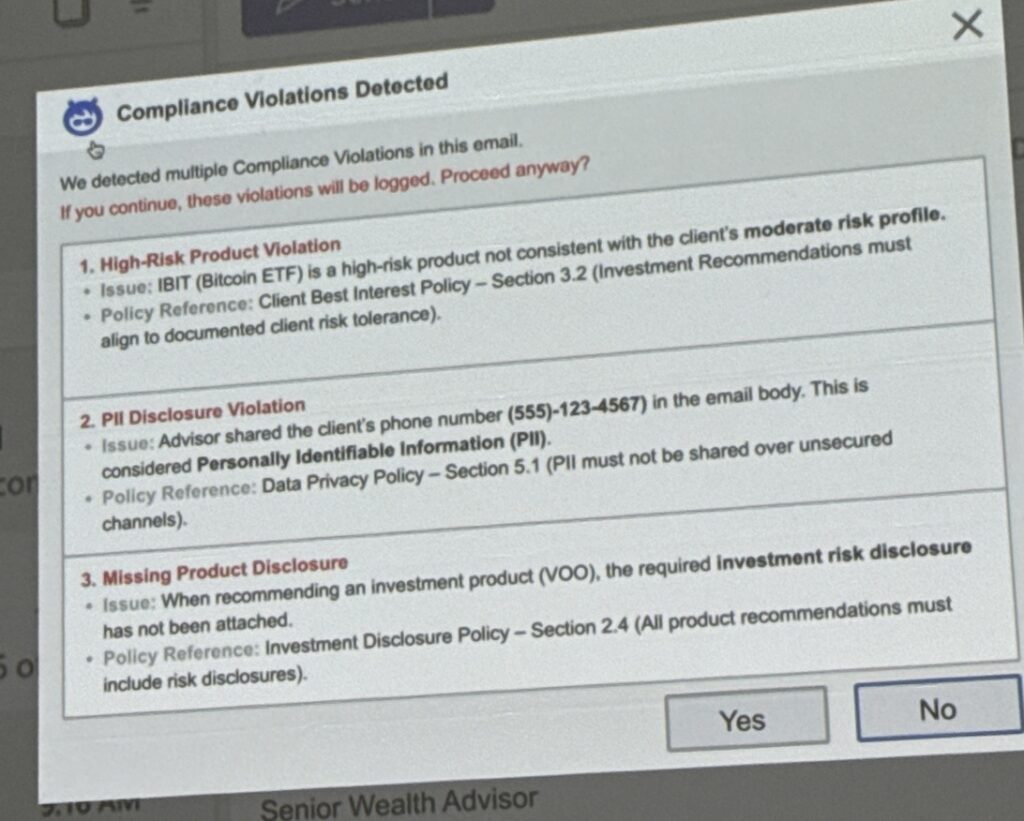

In a demo, they showed an email being sent by an advisor that violated three policies (see pic below).

They also showed a Compliance Command Center (note — this is a roadmap item).

Compliance Command Center (Roadmap)

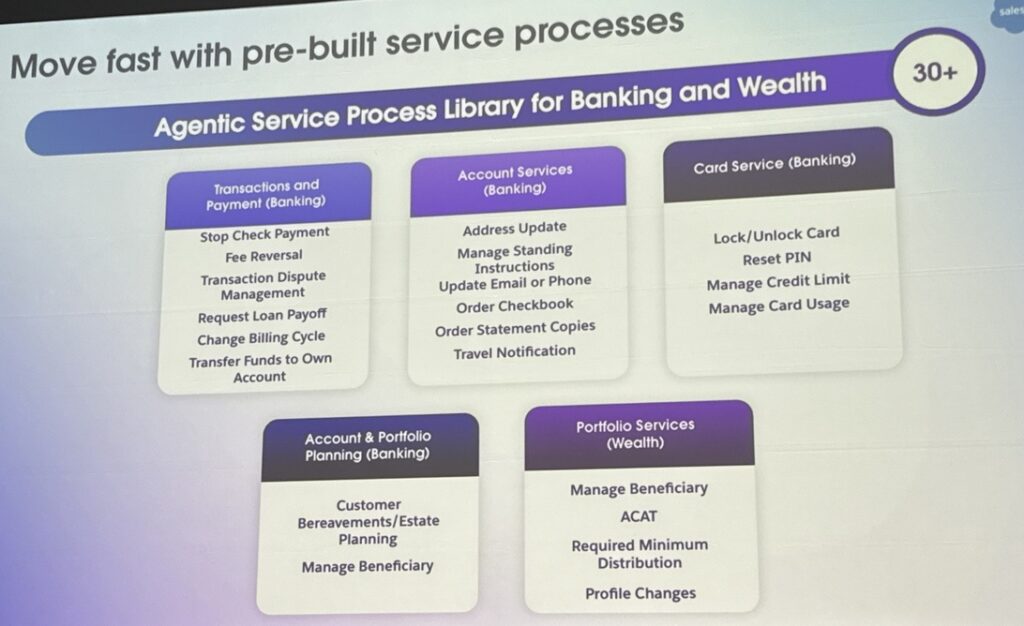

This next slide shows the processes Salesforce said were available today for financial services, including those for wealth management:

- Manage Beneficiary

- Automated Customer Account Transfer Service (ACAT)

- Required Minimum Distributions (RMDs)

- Profile Changes

Session: Empower Wealth Advisors with Industry-Specific AI

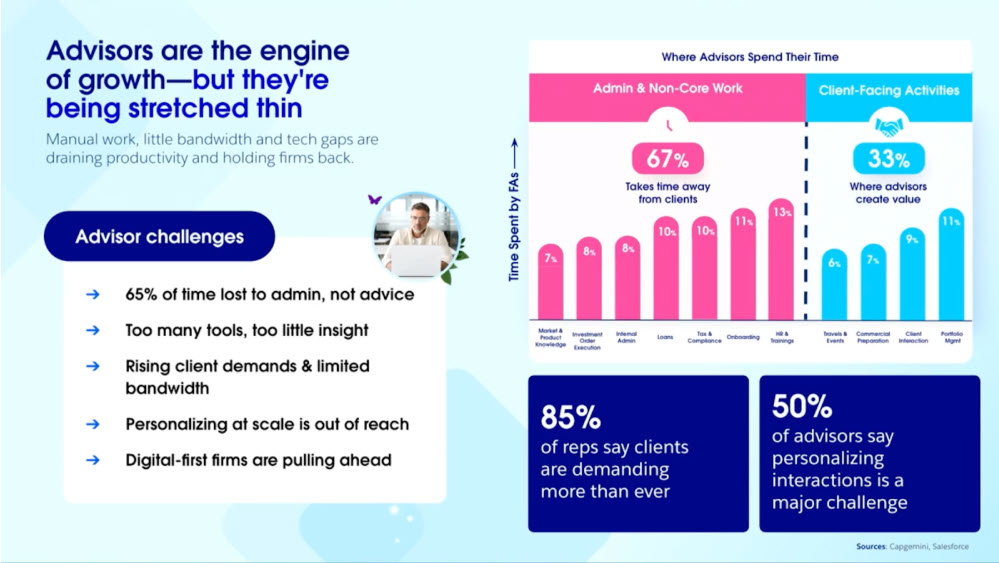

This last session was presented by Drew Seelig and Jeremy Schowalter. They began the presentation with an unsurprising problem statement: Advisors don’t like entering data.

Additionally, today’s advisor tech is dated and ineffective. As shown in this slide, administrative and non-core tasks are taking precious time away from client-facing activities.

- 65% of time is being spent on “admin, not advice.”

- 85% say clients are more demanding than ever.

- 50% say personalizing interactions is a major challenge.

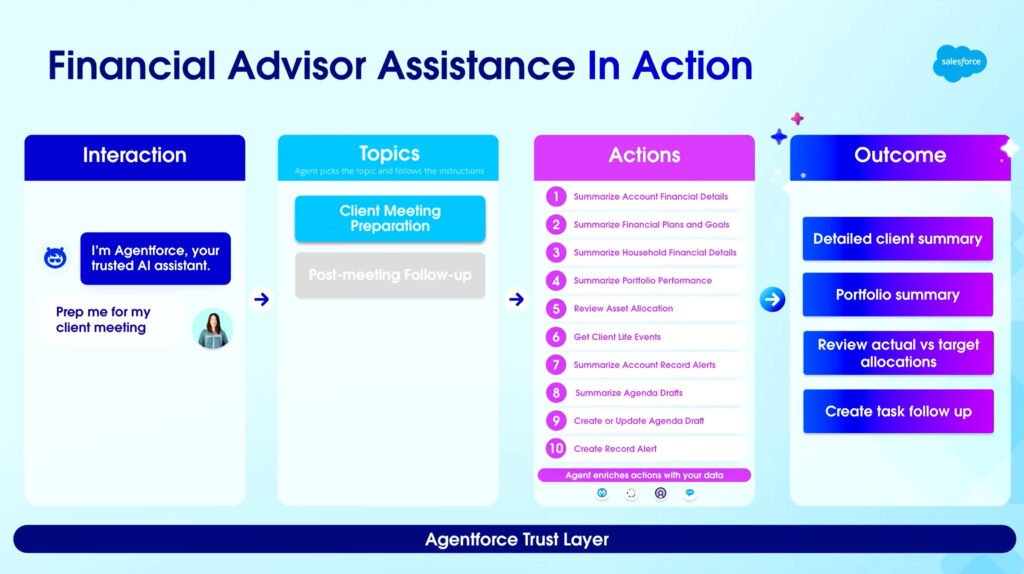

So how does Agentforce help solve this? The framework is as follows:

- Interactions — you ask Agentforce for assistance through prompts.

- Topics — based on the prompt, the agent picks a topic (e.g. Client Meeting, Post-Meeting Follow-Up) and follows the instructions.

- Actions — topics are comprised of Actions where agents go to work performing tasks (e.g. Summarize Account Financial Details, Summarize Financial Plans and Goals, Summarize Household Financial Details, Summarize Portfolio Performance, etc.)

- Outcome — agents produce items such as a detailed client summary, portfolio summary, a review of actual vs. targeted allocations, and/or task follow-ups.

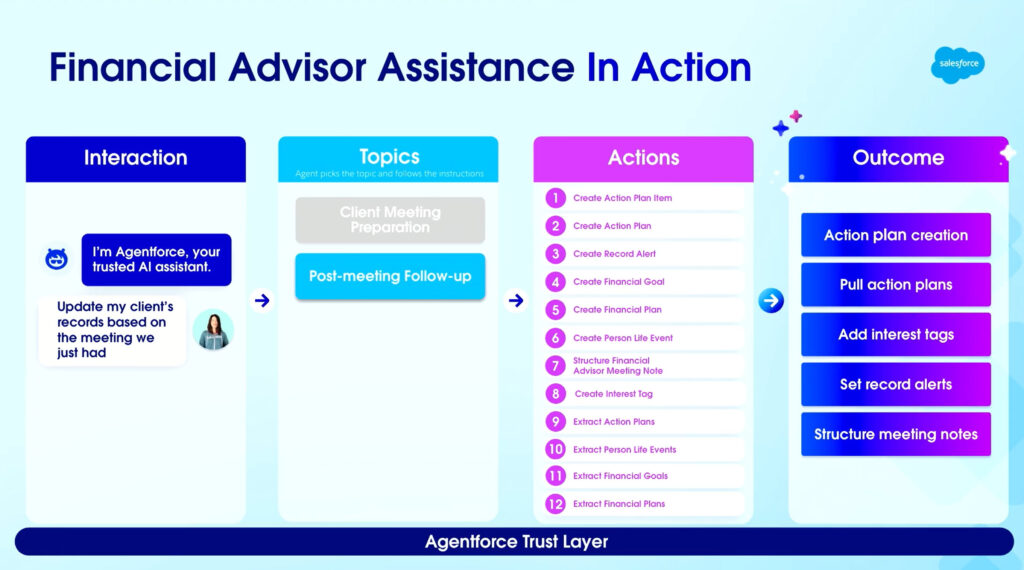

During the demo, we were shown 10 actions for meeting prep, and 12 for post-meeting follow-up. The actions are generally available as of Dreamforce 2025. Some of the options shown were:

- Create Financial Plan

- Create Financial Goal

- Create Person Life Event

- Extract Action Plans

- Review Asset Allocation

- Create or Update Agenda Draft

- Summarize Account Financial Details

- Summarize Portfolio Performance

- Summarize Financial Plans and Goals

Client Meeting Preparation Actions

Post-meeting follow-up actions:

Post-Meeting Follow-up Actions

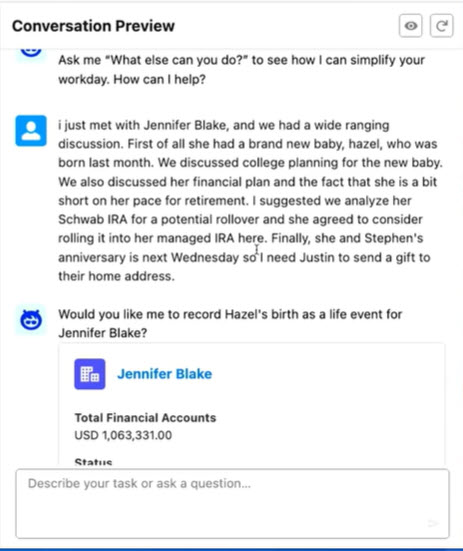

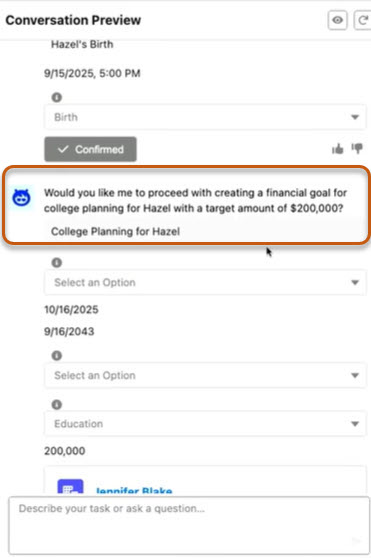

In the demo, a financial advisor meets with a client who recently had a child. Upon conveying this information in a conversation with an agent, the agent prompts the advisor by asking: (1) Do you want to record this as a Life Event in Salesforce? (2) Do you want to create a Financial Goal for college savings? The screenshots below show the interaction between the advisor and the agent:

Conclusion

The big takeaways for me were related to the potential shift in how we might interact with a customer relationship management (CRM) platform — from clicks and data entry to using prompts or having a conversation with an AI agent to retrieve and produce the information we need. I think we all know at this point that the big return on investment (ROI) for using AI at a registered investment advisor (RIA) firm is to free up a financial advisor’s time to have more revenue-producing client interactions. Meeting prep, summary, and follow-up is the low-hanging fruit, and we’ve seen a host of off-the-shelf point solutions like Jump.AI, Zocks.io, and Zeplyn.ai enter the wealth management space to solve this need. Salesforce has demonstrated their ability to address this need with their prebuilt and customizable Agent Actions.

Off-the-shelf point solutions have the advantage of easier plug-and-play configuration. Agentforce has greater capabilities, but requires a high level of technical expertise to configure, manage, and fine-tune. By having preconfigured agents, Salesforce is going to claim it has agents for wealth management out-of-the-box. But, at least right now, you must be using the Core version of FSC (which was only recently released), and it assumes you are using standard objects to store client data. If you want an agent to pull data from a custom object, the agent will have to be modified.

I suspect the tipping point for an RIA on which path to follow (off-the-shelf or Agentforce) will come down to a firm’s IT resources (or access to a consulting partner like ShellBlack) and scale. With half of all RIAs having 10 or fewer employees, and 90% having fewer than 50, Agentforce is likely to be too onerous for all but the largest RIAs.

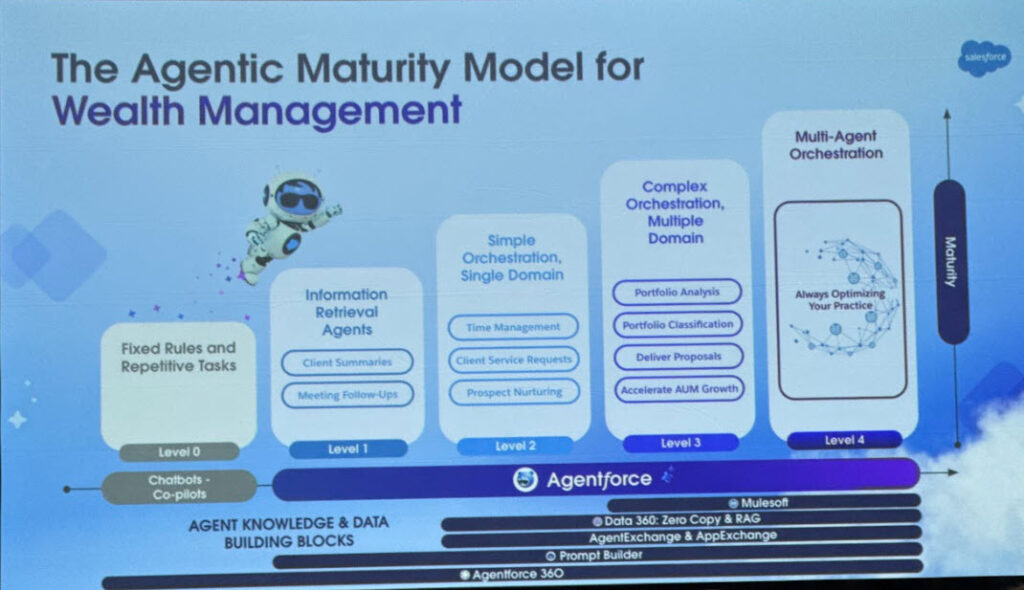

This next slide shows how complex the model becomes and outlines which tools and platforms are necessary to build the foundation for each level of integration.

Salesforce Agentic Enterprise

Curious how the agentic enterprise could fit into your firm’s technology strategy? Whether you’re exploring Agentforce Financial Services or evaluating how AI agents could enhance advisor productivity, ShellBlack can help. Contact us today, and one of our certified Salesforce consultants will walk you through the possibilities for your organization.

Author credit: Shell Black, founder and president at ShellBlack