Key Takeaways and Themes from Dreamforce 2024

Dreamforce 2024 has come and gone. It was a whirlwind of information, presentations, and announcements that I’ll try to condense into a dozen or so key takeaways. Where possible, I’ll focus on themes with the greatest relevance to the Salesforce wealth cloud to resonate with our readers, customers, and colleagues in Financial Services.

Keep Your Job — But Leave the Repetitive Work to AI

Let’s call it out. There is some general fear and apprehension that AI will take away people’s jobs. Salesforce was deliberate and intentional with its narrative that AI is here to “augment and support” humans, not replace them. Agentforce was rolled out as a customizable, scalable way for humans with AI Agents to drive customer success together.

Courtesy of Salesforce

The stat repeated at Dreamforce was that 41% of time is lost to low-value and repetitive tasks. AI works 24/7 — even when a human is not available. It can also be proactive, all of which provides scale to your wealth organization through the Salesforce cloud.

Courtesy of Salesforce

“Declare war on process waste!” Save time and increase productivity — free people up from the work that users see as “chores.” One stat that resonated with me is that most people can type about 40 words a minute, while AI is typing 250 words a minute. Think of the huge time savings over hundreds or thousands of customer service representative (CSR) interactions in a year. CSR productivity can improve 20–40% with AI.

Don’t DIY AI

This concept was introduced in the keynote and carried over into many of the individual sessions. Salesforce presenters made the valid argument that creating your own large language model (LLM) probably doesn’t make financial sense. You have to build it, train it, keep the data up-to-date, then retrain it — all of which takes time and money over the entire life of the LLM.

Know the 3 Types of AI that Can Help You in Salesforce

- Predictive — This type of AI answers the question, “What should I do next?” Predictive AI equips wealth firms to be more proactive and less reactive with customers.

- Generative — Generative AI helps humans get the job done by curating emails, meeting summaries, and more.

- Autonomous — Autonomous agents can actually do specific tasks on the human’s behalf. For example, Agents on a client portal can handle a request to change a beneficiary with no human interaction.

Courtesy of Salesforce

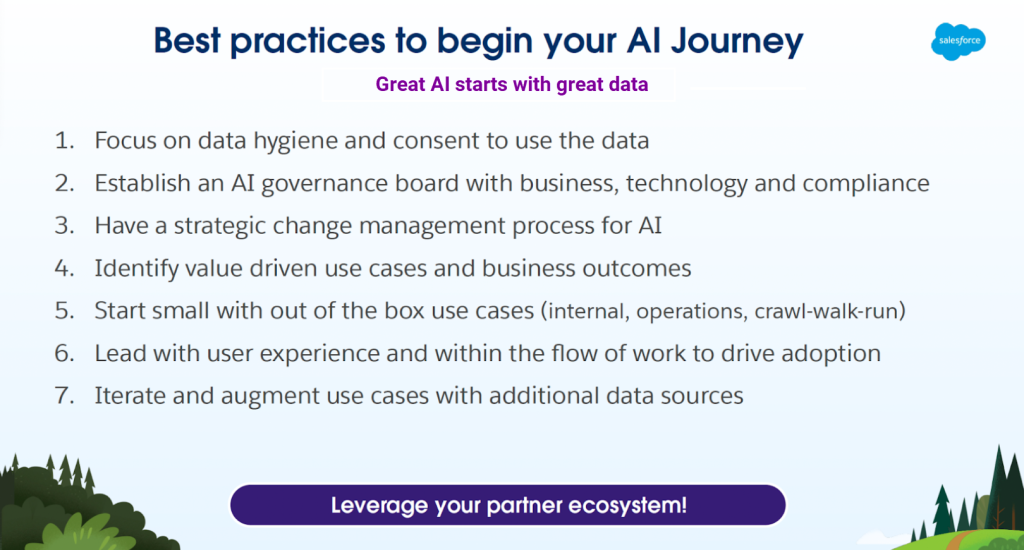

Get AI-Ready

Over the last couple of years, Salesforce has been amplifying its messaging at Dreamforce to urge everyone to get their data in order and to have a data strategy. For example, how do you show 50 data points, some of which reside outside of your client relationship management (CRM) system, on a client household and make it actionable? It starts with a data strategy. For most companies, a data strategy will be a multiyear journey, and it’s the key to getting AI-ready.

- Step 1 — Understand exactly what data is available (sales, marketing, compliance, finance, etc.).

- Step 2 — Make relevant data accessible and available. AI needs access to activate your data, but remember that too much data can get unwieldy. Focus only on data that will help people be more productive.

- Step 3 — Clean up your data. Some of this “data readiness” pertains to your organization. For example, AI uses Flows, so get your business processes off of Process Builder and Workflow. AI also reads your metadata, which can include Help and Description information in your custom fields. This will help AI know if Apple is a company or a fruit! Data quality is essential for generative AI to maximize accuracy and minimize hallucinations.

From what I’m hearing, Data Cloud is required for any AI initiative that leverages data outside of Salesforce. Though mostly aspirational for many Salesforce customers due to cost, if you’ve achieved Customer360 or Client360 (which runs on Data Cloud), you’re ready for AI.

Decide Where to Focus

Perhaps the most frequently repeated mantra at Dreamforce 2024 was this: Don’t do AI just to do AI. Start with the experience you want to deliver and build from there. For example, your initial focus might be to improve the productivity of users by reducing tedious and repetitive tasks. If you don’t consider the experience first, you’re likely to have adoption issues.

Courtesy of Salesforce

Start with Internal Use Cases

Start with internal use cases before tackling external functionality. In other words, provide AI services to your employees before deploying AI to your customers. This allows your team to get familiar with the capabilities in a low-pressure environment without seeming to use your customers as test subjects.

The framework below might be useful for you as you build out an initial use case:

- Role — Create the initial use case for a Business Development Rep (BDR).

- Data — Define what data the AI Agent needs (e.g. transaction data).

- Actions — Establish guardrails — what the Agent can or cannot do.

- Channels — Decide how the Agent will interact with the customer — think chat, phone, or email.

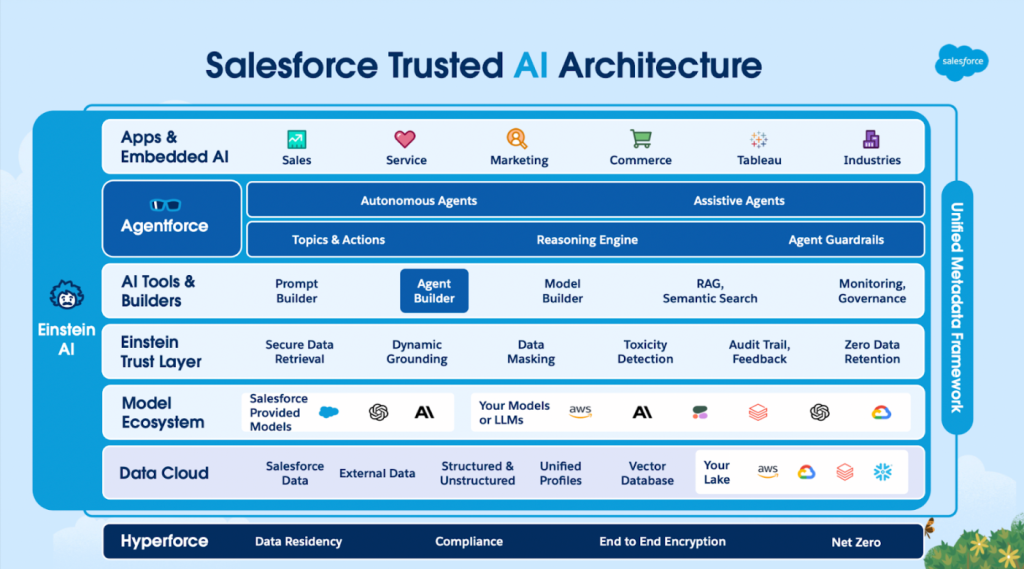

Peek Inside the Salesforce Tech Stack for Agentforce

Let’s get techy for a moment. In the slide below, the dark blue sections are the features announced at Dreamforce 2024. Together, they compose the newly launched Agentforce.

Courtesy of Salesforce

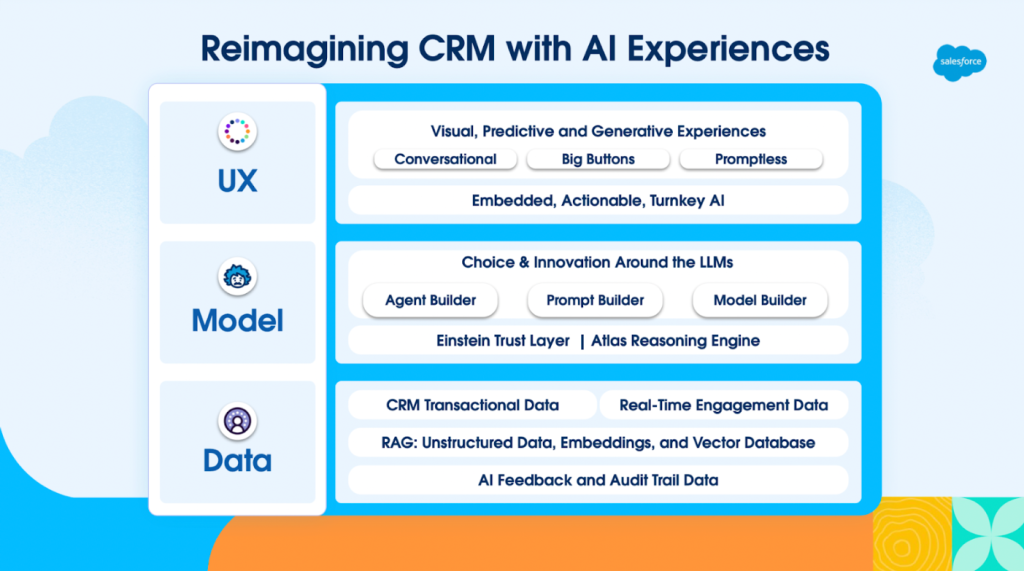

Peel Back the Data Layers

The middle “Model” layer in the image below shows the tools that Salesforce released in the last couple of years to get us ready for the top “UX” layer, or Agentforce.

Courtesy of Salesforce

Within the UX layer (now known as Agentforce), let’s expand a bit on the three key words shown in the slide:

- Conversational — These could be AI-powered chatbots that can carry out a service via chat conversion.

- Big Buttons — This refers to a literal big button on the page to call attention to an action that needs to be taken by the User.

- Promptless — Promptless functionality means that AI is listening and suggesting.

Consider Your Options for AI Agent Use Cases

Here are some sample use cases that can help you to start thinking about how you could use AI in your organization:

Front Office Use Cases

- Prospecting Agents

- Customer Service Agents

- Onboarding Support

- Post-Call Automations

- Create client call summaries

- Highlighting key points

- Post action items

- Advisor Assistant

- Sales Coach

- Create persuasive sales scripts

- Adapt scripts for wealth management products and services

Back Office Use Cases

- Investment Research Assistant

- Compliance Assistant

- Corporate Actions Assistant

- Client Summaries

- Summarize the client’s profile to include:

- Portfolio

- Service

- Tasks

- Recommended preparation for client meetings (link to RBC Wealth blog post once it’s published)

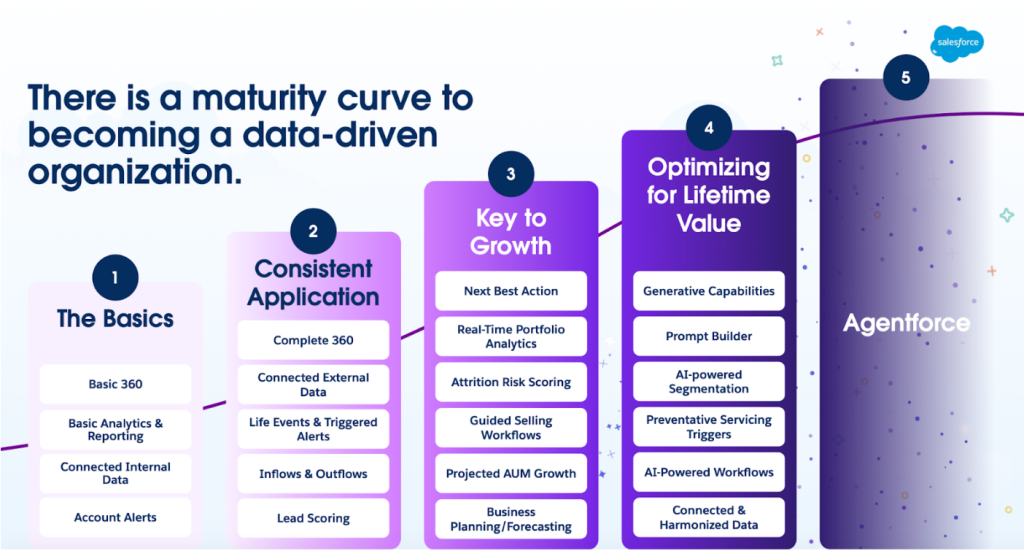

Pinpoint Your Maturity as a Data-Driven Organization

In the chart below, you can see that the journey to becoming a data-driven organization is a multistep process that builds on the basics. Let’s focus on some of the highlights.

Courtesy of Salesforce

- Columns 1 and 2 — Both of these categories are predicated on achieving Customer360. Column 1 is focused on internal data, while Column 2 expands the data sets to include external information.

- Column 3 — Predictive AI can be a powerful driver of growth. Think “next best action,” identifying customers at risk of attrition, spotlighting leads most likely to convert, or presenting best product or service recommendations.

- Column 4 — Generative AI further optimizes processes by creating voice transcripts of a call, summarizing key points and action items from a meeting, and more.

- Column 5 — Agentforce represents peak maturity for a data-driven organization, incorporating automated Agents that respond directly to customer service chats.

Think of Industries AI as Your Starter Kit

As if there weren’t already enough to observe during Dreamforce, it’s worth mentioning that just prior to the event, Salesforce announced Industries AI — a collection of more than 100 industry-specific prompts to kick-start your Agentforce experience. Think of them as starter templates designed with common use cases in mind.

Courtesy of Salesforce

I was able to get some clarity on the Finance Agents from a Salesforce Solution Engineer while at Dreamforce. Out-of-the-box templates leverage Native Objects, or the Custom Objects that come with Financial Services Cloud (FSC) — but the prompts can be modified based on your organization. For example, if you do not use Financial Plans in FSC (and don’t feel bad if you don’t, they’re rarely used by customers), you can leverage your Custom Objects instead.

Here are the AI use cases for Financial Services.

Get Excited About AI on the AppExchange

It wasn’t until I attended a session geared toward Partners that this light bulb went off: Independent software vendors (ISVs) who are AppExchange Partners will be able to include AI features in their packages. I could see AppExchange listings having an “AI Enabled” designation much like they did when the Lightning UX rolled out.

What’s Next for YOU on the AI Front?

A lot is riding on Agentforce for Salesforce — and they know their success hinges on how eager their customers are to take the next step to integrate AI into their operations. Similarly, a lot is riding on the opportunities of AI among wealth firms that are ready to embrace it. ShellBlack can help you get your data in order so that you’re fully prepared to make an informed decision about whether AI is right for your firm.

Remember, though, “Don’t do AI just to do AI.” The ROI for AI will be rooted in the potential for your organization to increase sales or drive down service costs through higher productivity.

If your organization is ready to start a conversation to decide whether AI solutions from Salesforce are right for you, contact ShellBlack.

Author Credit: ShellBlack, Founder and President at ShellBlack